WHAT IS LITHIUM?

Elementally lithium is the lightest solid metal in existence, but it does not occur freely in nature. It occurs as a compound in specific hard rock minerals, sedimentary minerals and dissolved in waters around the globe. Lithium as it occurs, cannot be used commercially, it must under-go chemical extraction and purification processes, to refine a specialty chemical that is used in all types of industries from grease to electric vehicle batteries

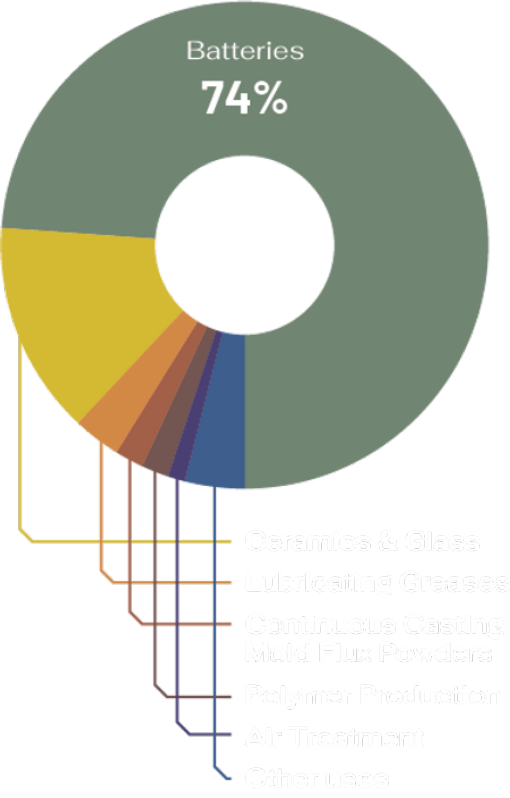

USES OF LITHIUM

Lithium has a range of industrial applications, including the manufacture of multipurpose greases, medications, glass, and ceramics. These applications accounted for most of the end use demand until 2018. Since 2018, the production of lithium-ion batteries (LIB) used in portable electronics, electric vehicles (EV), and energy storage systems (ESS) has emerged as the dominate market for lithium today, totalling 74% of end use demand in 2022, forecasted to reach 92% by 2030 (Benchmark Mineral Intelligence, 2022)

As governments increase their concerns around climate change, policies are shifting towards actionable measures to reduce global emissions. This includes the uptake of zero emission vehicles which includes EV’s. This will have the largest impact on lithium demand in the upcoming decades, as the LIB is the preferred technology in EV applications due to its relatively low cost and high energy density. Electric vehicle sales as a share of total car sales were approximately 12% in 2022 and expected to surpass internal combustion engine sales in 2035, indicating a strong demand for both LIBs and lithium into the next decade. (Benchmark Mineral Intelligence, 2022).

SUPPLY & DEMAND

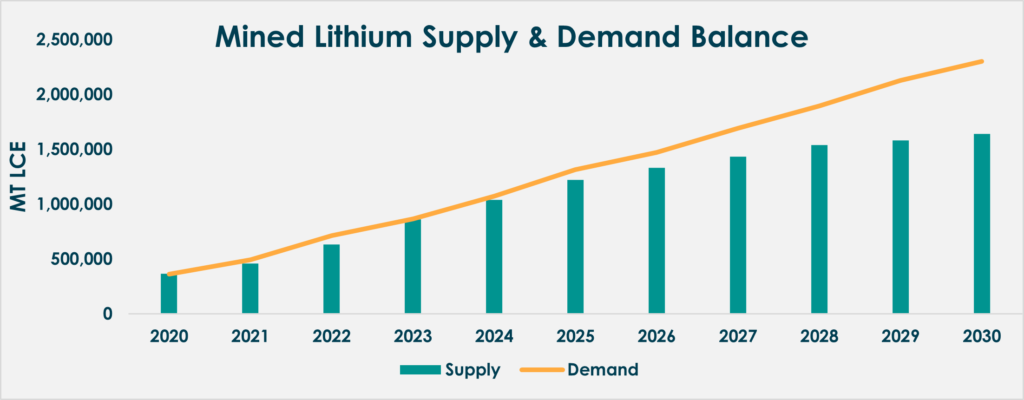

The uptake of electric vehicles and increased production of lithium-ion batteries brought the global lithium demand in 2021 to 494,000 t LCE with a total global supply of 460,000 t LCE. Resulting in a lithium supply deficit of approximately 34,000 t LCE. Supply & Demand forecasts anticipate the demand to increase over 360%, reaching 2,300,000 t LCE in 2030 (Benchmark Mineral Intelligence, 2022).

The rapidly increasing demand for lithium combined with inadequate investment into the development of the upstream lithium supply chain has driven the price of lithium to new heights. With prices increasing over 500% from early 2021 to the end of 2022, new lithium resources become more attractive and economically feasible to extract.

Mined Lithium Supply and Demand Balance

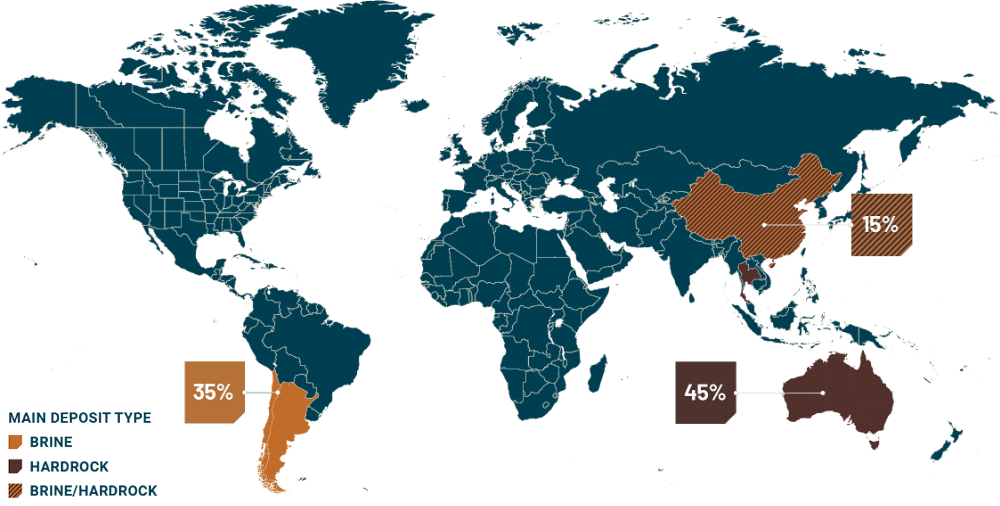

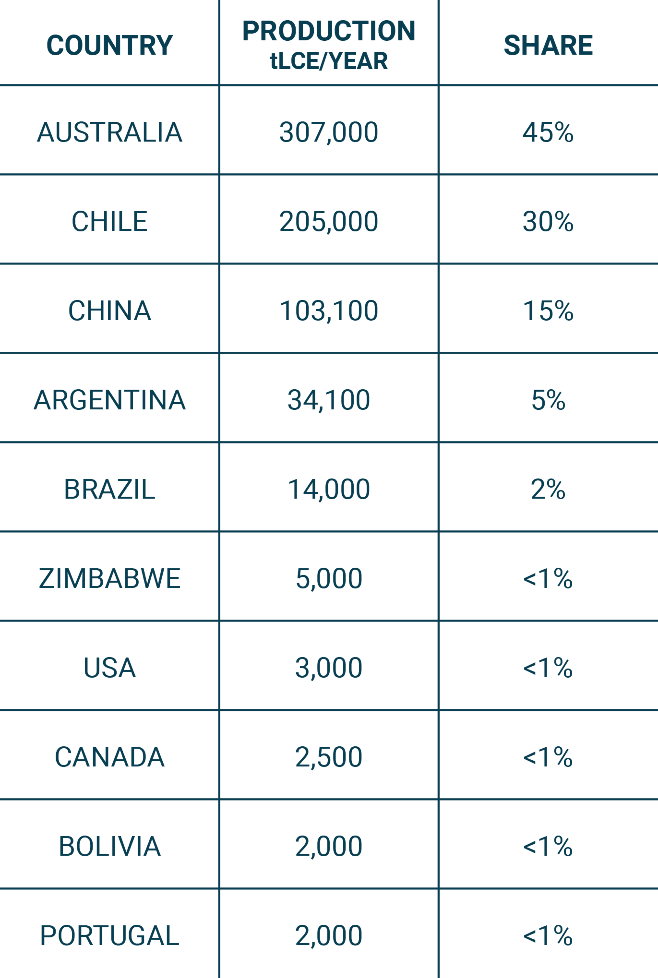

LITHIUM SUPPLY AS OF DECEMBER 2022

The rapidly increasing demand for lithium combined with inadequate investment into the development of the upstream lithium supply chain has driven the price of lithium to new heights. With prices increasing over 500% from early 2021 to the end of 2022, new lithium resources become more attractive and economically feasible to extract.

For each type of lithium resource, there is a minimum lithium concentration or grade at which lithium chemicals can be produced economically. This is known as the Mineralogical Barrier.